A wise person was once asked “When is the best time to plant a tree?” and they replied, “20 years ago, but the second best time is today”.

How does this relate to the present cost of living crisis? Well, the best time to get on top of personal finance was probably 10 or 20 years ago, but the second best time is now, today.

The challenges we are facing, with rising prices and the prospect of increasing rates of interest, offer an ideal opportunity to reset your relationship with money. For individuals you might re-design your financial priorities, build your money knowledge, set financial goals, and take action to meet these objectives. For those working in human resources you might consider financial wellbeing initiatives in the workplace.

This blog discusses the current crisis and explores how you might respond.

Professor George Callaghan

George Callaghan is Professor of Economics and Personal Finance at the Open University, and Director of Positive Money Habits. He is also a certified Executive Coach, with multiple accreditations from leading coaching bodies.

His vision is to empower employees and individuals to build positive money habits. He does this by helping groups and individuals understand practical, psychological, and emotional issues around money. By combining education with an understanding of money emotions, people can transform themselves and contribute more to their employer, family, and wider society.

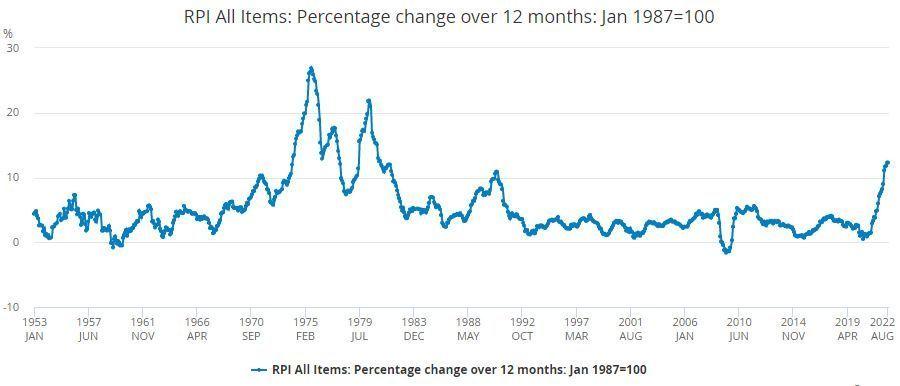

The chart below helps explain why the current rate of increase in prices is so shocking – we have not encountered such rates for 30 years (ONS, 2022). The UK last had double digit inflation in 1980 – over 40 years ago.

Chart showing the UK Retail Price Index (RPI) for period 1953 to 2022. Source: Office for National Statistics.

Inflation matters because it erodes the purchasing power of money. If your income stays the same and prices increase, then you can buy fewer goods and services. What is especially tough is that while we are experiencing a general rise in prices there is a particularly sharp increase in the cost of electricity and gas. While we should celebrate improved living standards which have seen the proportion of centrally heated homes increase from 59% in 1980 to 95% in 2018 (Statista, 2019), this means pretty much every household is facing large increases in energy bills. Poorer households on pre-paid meters are facing particularly high rates.

In my work as a money and career coach I adopt an approach based in appreciative inquiry – and this is a very useful starting point in formulating your response to present challenges.

It starts by inviting you to recognise your strengths, assets, goals, and aspirations. It does not deny or ignore very real problems and challenges you might face, rather it offers a process of inquiry which helps uncover financial wellness solutions. With money issues, typical questions you might ask yourself are:

- What is working now?

- What is of greatest value to you?

- What are your hopes and dreams around money?

- What skills and talents do you have?

- What brings you joy around money?

The premise is that – while there are national and global economic forces shaping economic challenges, you have strengths on which you can draw to make choices and act.

Start by establishing a clear picture of how much money is coming into your household and how much is being spent. These total spending figures can then be split into different categories. I would invite you to be completely honest here and, if it feels appropriate, to include other household members in this task. You can use on-line banking for the details or keep receipts for a month and log every spend. Don’t forget to include annual expenses like holidays, Christmas, and car repairs – just average these out over 12 months.

This will let you know where you are now. The monthly surplus/ deficit might not be what you had hoped, but it clarifies options. You might then ask, “What are my spending priorities?” Some are pretty much non-negotiable, such as council tax and energy bills. You might then decide to reduce outgoings on whole categories of spending (mobiles, TV subscriptions, foreign holidays and so on), substitute expensive for cheaper goods and services (budget supermarket; own brand produce) and delay some purchases altogether (new car; holiday). In times of acute crisis, you might even consider a break from regular savings and investments – but think this one through carefully.

Obviously, those living in poverty will face constrained choices – and indeed most households are going to have to make trade-offs. But given the potential scale of economic challenge, there is merit for all in going through this process.

You might also ask “What skills and talents do I have that increase income or cut spending?” Might more home cooking replace meals out? Might you have skills and talents that would enable you to help others less fortunate?

It might also be worth reflecting on hopes and dreams. Of course, when money is tight this might sound odd, but goals give focus, provide energy, and can improve motivation. So increasing your level of qualification through training could be helpful.

Engaging in one to one or small group coaching can be of great assistance in this process of appreciative inquiry. But regardless of whether you seek out professional support there are real gains to be made around talking about money with household members. For instance, what are their fears in relation to money, what are their financial aspirations?

I would like to leave you with a reflection and an invitation.

The reflection draws on our shared economic history. Back in August 1975 UK inflation reached 26.9% and was 21.9% in May 1980. Despite challenges and hardships not only did we come through these tough times, but we also went on to become a much wealthier society. For example, the average inflation adjusted household income increased from £18,049 in 1980 to £37,622 in 2021 (ONS, 2021).

The invitation is to try out appreciative inquiry. The negative daily news cycle creates a climate of fear, uncertainty, and passivity. But while there is no denying price increases (particularly energy) are substantial, there is much we can do individually and collectively. Start by recognising your strengths, assets, goals, and aspirations. Identify your locus of control and begin to act. You might include other household members. And then think about other communities you are part of – might you help organise financial wellbeing initiatives in the workplace?

Cost of living crisis: How can you help yourself or your employees?

Shocks such as the present cost of living crisis will increase economic hardship for many households. But might they also stimulate meaningful discussions around money? Taking steps to improve your financial wellness may mean you emerge from the present challenge with greater financial strength and resistance.

There is much we can do on our own, but even more we can do by working with a money coach.

Professor George Callaghan offers one-to-one and small group sessions in financial coaching. If you would like to book for yourself, or if you are employed within a human resources capacity and would like to arrange coaching for colleagues, please contact Thrive4Life or email us at info@thrive4life.co.uk